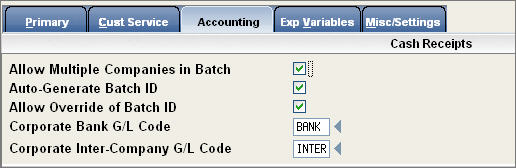

There are a few options and settings in the Cash Receipts Entry program that are controlled in the Company Master; both in the Systems Control Master and the Company Master for the specific company id. Settings include, which default abbreviated General Ledger code to use for the Bank, if multiple companies are allowed in one batch, if batch id's are automatically generated, etc.

![]() You must have the appropriate security level to modify any of these options in the Master File.

You must have the appropriate security level to modify any of these options in the Master File.

These are fields that should be set in the system master in the Company Master under the Accounting Tab. This is one of the first files to be set up in your system when 'Getting Started'. Click here for detailed instructions on setting up the Company Master.

|

Allow multiple companies in cash receipts |

Can payments from multiple companies all be entered in the same batch? A |

|

Auto generate batch ID for cash receipts |

Should the system automatically generate a batch ID for the batch? This saves keying time for the user. A |

|

Allow override

|

If a batch ID is automatically generated (above option), can it be changed? A |

|

Corporate bank G/L Code |

The default general ledger code to use for the cash receipts batch. |

|

Corporate inter-comp G/L |

If multiple company cash receipts are used this is the credit side of the general ledger entry |

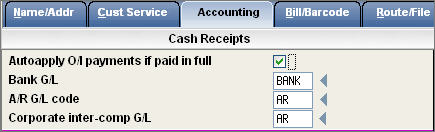

In the Company Master file, the Company Master record for the specific company ID, there is one option available for Cash Receipts in addition to the default GL codes for each batch. The Auto apply option controls the application of payments against invoices when the customer's balance is paid in full. The does NOT apply to balance forward accounts. A ![]() indicates yes and a

indicates yes and a ![]() indicates no.

indicates no.